In this post, we’ll unpack all you need to know about the book Technological Revolutions and Financial Capital, including a breakdown of the core framework, the 5 technological revolutions, the 4 phases of each revolution, the role of financial capital versus production capital, key takeaways and more.

What Is Technological Revolutions & Financial Capital?

Technological Revolutions and Financial Capital is a book by Carlota Perez that explores how major technological shifts unfold in predictable patterns.

The book offers a framework for understanding the relationship between innovation and finance and how this dynamic transforms institutions, the economy and society.

The Technological Revolutions & Financial Capital Framework

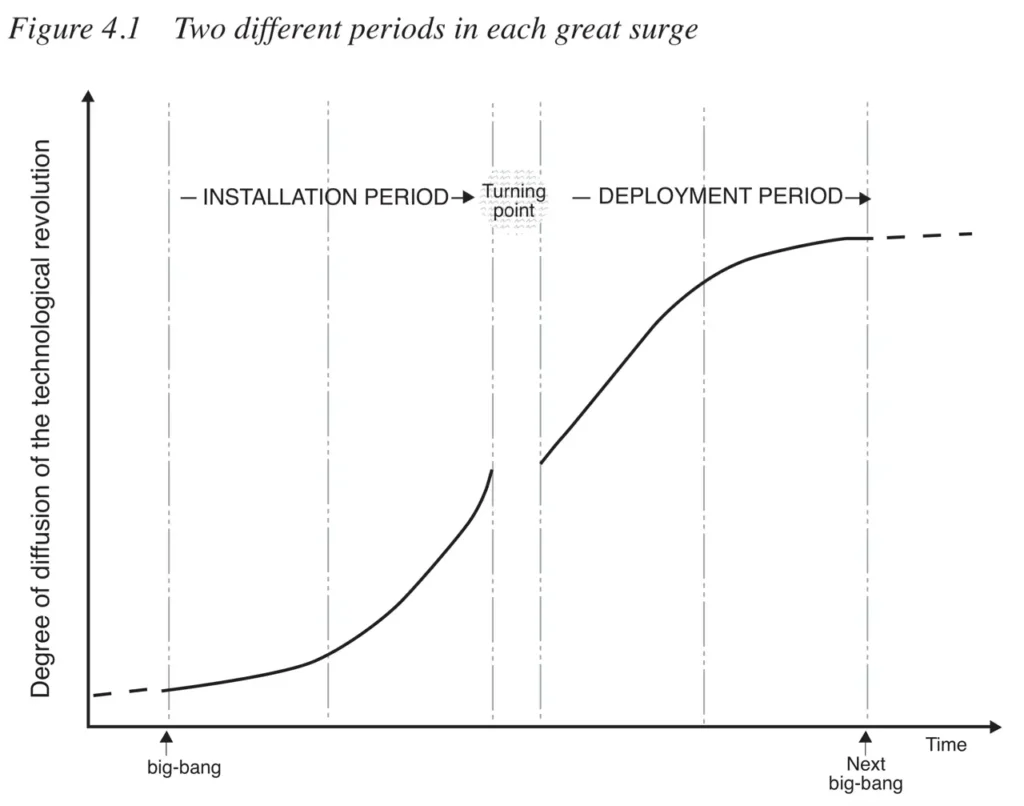

Every technological revolution follows a recurring cycle made up of 4 key phases: the installation phase, the frenzy phase, the crash phase and the deployment phase.

While financial capital plays a vital role in igniting a revolution, it must eventually give way to production capital to deliver widespread economic benefits.

What Is A Technological Revolution?

A technological revolution can be defined as a powerful cluster of breakthrough technologies that reshape industries and trigger a cycle of economic and also social change.

The 5 Technological Revolutions

Perez identifies 5 major technological revolutions that have shaped the modern world over the past 250 years:

- The Industrial Revolution

- The Steam & Railways Revolution

- The Steel & Heavy Engineering Revolution

- The Oil, Automobiles & Mass Production Revolution

- The Information & Communications Technology (ICT) Revolution

Each of these revolutions reshaped the institutions, the economy and also the society of their time.

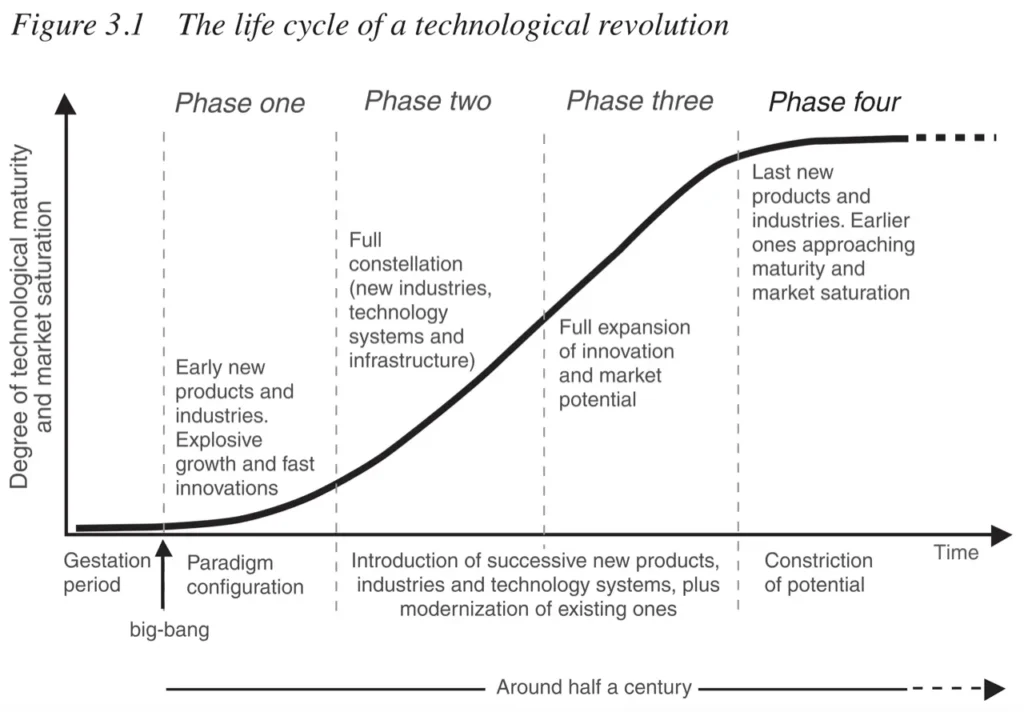

The 4 Phases of Each Revolution

Each revolution unfolds in 4 distinct phases.

- Firstly, the Installation Phase which sees new technologies emerge and attract speculative capital.

- Secondly, the Frenzy Phase which brings rapid investment, bubbles and inequality.

- Thirdly, the Crash Phase which marks a turning point where bubbles burst and financial capital retreats.

- Fourthly, the Deployment Phase which scales innovations into the real economy.

This sequence recurs roughly every 50 years and is based on causal mechanisms that are inherent in capitalism.

The Installation Phase begins with a battle against the old order which is ingrained in the existing system. Only when that battle has been practically won can the new revolution truly diffuse across the entire economy of a nation and later across the world.

The Frenzy Phase is a time of fierce competition, speculation, corruption and unshared even widely celebrated love of wealth. Individualism flourishes both in business and in political thinking, sometimes confronted by anti-technology or anti-system ideas or groups.

The Crash Phase brings the collapse of unsustainable speculation, the exposure of corruption and a widespread loss of trust in financial elites. It often prompts calls for regulation, institutional reform, and a rebalancing of the relationship between finance and production.

The Deployment Phase bring stability and institutional frameworks are reshaped to guide investment toward productive use. Innovations become widely adopted, productivity rises and the benefits of the revolution are more broadly shared across society.

The Techno-Economic Paradigm

Each technological revolution introduces a new techno-economic paradigm — a new set of technologies, infrastructure and principles that redefine how the economy operates.

Each revolution sparks a surge of innovation — akin to a gold rush — and unleashes a wave of bold young entrepreneurs and investors who disrupt the old order by channelling vast amounts of time, energy and capital into emerging industries and infrastructure.

Innovators who see far into the future can experience great difficulty in being understood by others.

Trough trial and error, their actions accelerate innovation and generate the successful practices that gradually define the new era. However, they also bring volatility, inequality and economic imbalances that eventually demand correction.

The new paradigm becomes the dominant operating logic of the economy until it is replaced by the next revolution.

Financial Capital Versus Production Capital

Perez distinguishes between two types of capital: financial capital and production capital.

Financial capital fuels short-term speculation and the installation phase. Production capital fuels long-term growth and the deployment phase.

The tension between financial and production capital intensifies as speculative excess builds.

Eventually, a reset becomes necessary to restore balance.

This reset can take the form of a major crash or a series of smaller, successive crashes that gradually release pressure.

Creative Destruction

The phrase creative destruction refers to the transformative but chaotic process where new technologies and entrepreneurs dismantle existing systems, replacing them with more efficient ones.

This upheaval drives innovation and growth but also causes instability, inequality and financial bubbles before a new economic order is established.

Turning Points & Crises

Each revolution inevitably reaches a crisis point — typically a financial crash — where the excesses of the frenzy phase are exposed.

Each crash is a necessary reset and essential for unlocking the full social and economic potential of the revolution.

In the aftermath, attention shifts to reform. With financial elites now humbled and public trust shaken, new institutions, regulations and also safeguards are implemented to stabilise the system.

If done successfully, this ushers in a golden age. This is a period defined by full employment, productive investment and harmony between private gain and public good.

This marks a shift from finance-led growth to production-led maturity.

The Fundamental Causes Of The After-Frenzy Crash

All frenzy phases share one fundamental characteristic: they are structurally unsustainable.

There are three structural tensions that make it impossible to keep the frenzy process going indefinitely.

Firstly, tensions between real and paper wealth. In other words, asset prices inflate far beyond the underlying productive capacity of the economy.

Secondly, tensions between existing demand and potential supply of the new technologies. In other words, markets can’t absorb the full output of the new technologies as fast as capital is flooding in.

Thirdly, the tensions between those who are profiting from the bubble and those who are not. In other words, rising inequality creates social and political pushback that undermines the boom.

These tensions eventually trigger a breaking point that forces the system to reset and transition into the deployment phase.

A stalemate in technologies is the origin of recessions.

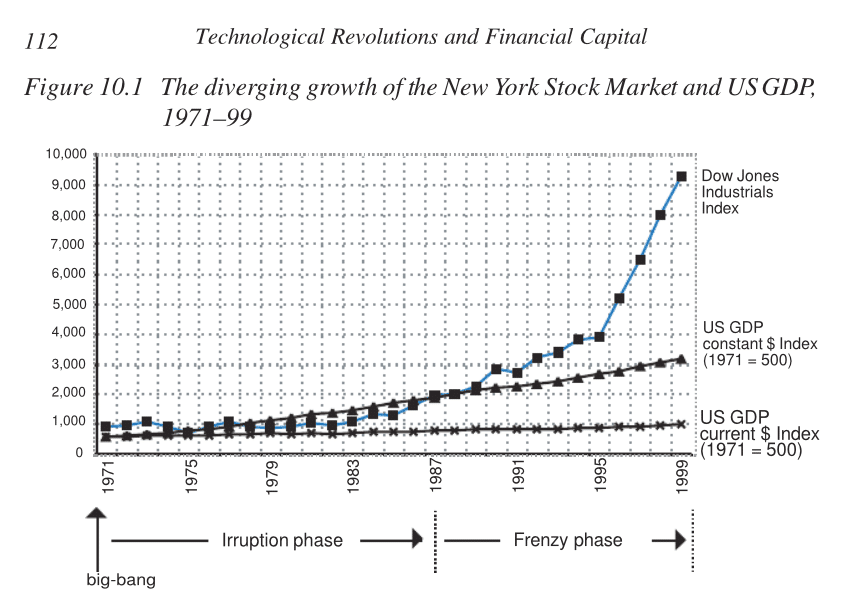

A Proxy For Financial Frenzy

Since the Dow Jones is quoted at current prices, the widening gap between the Dow and nominal GDP can be seen as a rough proxy for differential inflation — where financial assets rise faster than the broader economy.

In other words, when the Dow index rises significantly faster than nominal GDP, it reflects a growing preference for financial speculation (buying stocks) over productive investment (factories, jobs, innovation), which is the hallmark of the financial frenzy in a technological revolution.

Key Takeaways

- Technological revolutions transform society, the economy and institutions.

- Each revolution follows a predictable pattern.

- The 4 phases of a revolution are the installation, frenzy and crash and deployment.

- The role of capital plays a crucial role in each revolution.

- Financial capital fuels short-term speculation.

- Production capital fuels long-term growth.

- All frenzy phases are unsustainable and require a reset to restore balance.

Summary (TL;DR)

Technological Revolutions and Financial Capital by Carlota Perez offers a powerful lens for understanding how innovation and finance shape the economy in long waves.

By identifying the patterns of past revolutions, the book equips us to better anticipate and navigate the challenges and also the opportunities of the present and future.